Abstract:

Do citizens react to positive inducements? Are the effects long lasting? Are prizes an appropriate incentive for rewarding good behavior? What types of rewards help to crowd in moral incentives? These questions are common in the behavioral economics literature but have been hardly looked at in the empirical tax compliance literature. In this paper, we test the effect of positive inducements and rewards for compliers, by making use of a randomized experiment in which a Municipality of Argentina awarded randomly the construction of 400 individual sidewalks among the more than 70,000 taxpayers who had complied with the payment of their property tax during the previous year. Results indicate that rewarding taxpayers for good behavior has large positive effects. First, we find that conditional on construction the taxpayers who receive the reward were 8% more likely to continue paying. Second, we find that results tend to fade over time but at a relatively slow pace. Third, we find spillover effects for the neighbors of those who received the reward. These effects are not universal but seem to depend on the salience of the reward. Overall, these results have relevant implications for the literature and for policymakers.

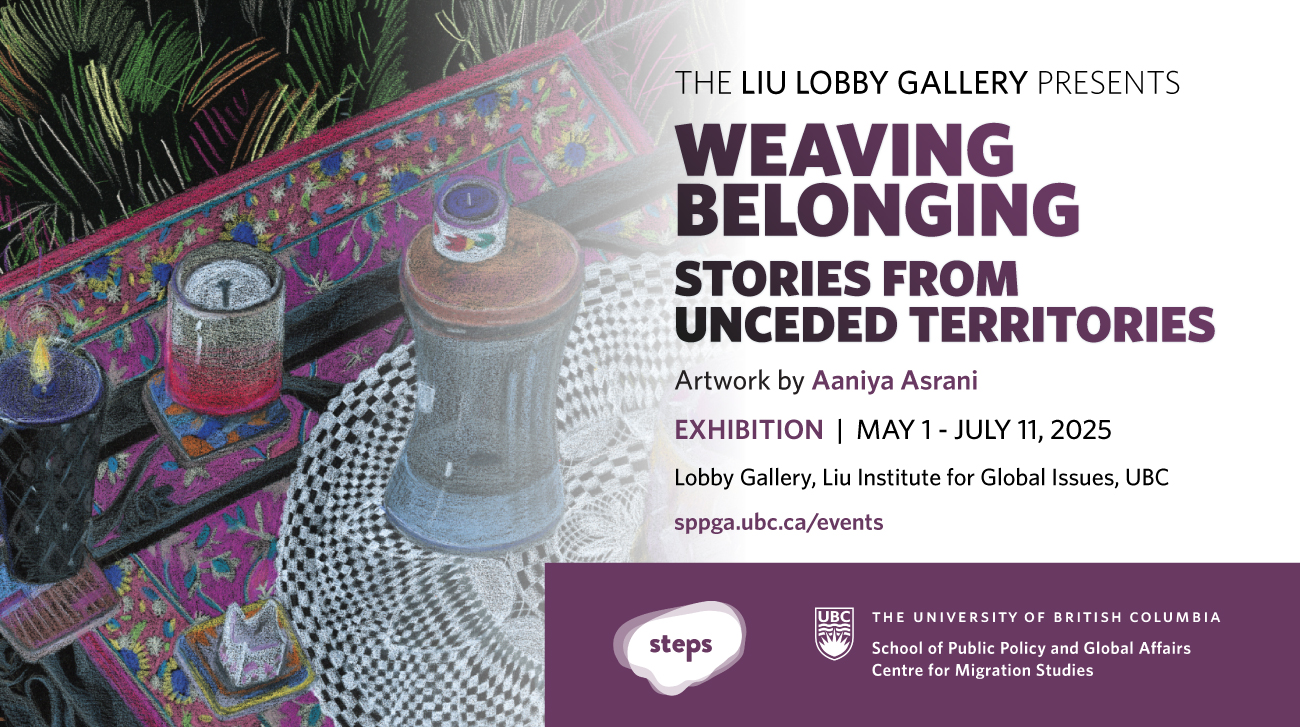

Please RSVP here.

See the full poster for the event here.